Know more: https://insuremytripus.pxf.io/c/3572823/1750338/20452

Travel insurance provides a vital safety net against unexpected costs that may arise due to the myriad things that can go wrong on the road. That includes everything from illness and injury to canceled flights and lost luggage to the death of a family member back home.

I know, it’s not fun to think about, but travel insurance is the single most important thing you should purchase before your trip. It’s something I strongly advise travelers to never leave home without (I buy it for every single one of my trips). I’ve seen it help many, many people over the years. Myself included.

It’s easier than ever to find a policy that meets your needs and budget, especially with tools out there like InsureMyTrip.

In this InsureMyTrip review, I’ll go over what the company offers and the pros and cons of using them as a service to use when planning your trip.

What Is InsureMyTrip?

InsureMyTrip is a valuable platform that simplifies the often-complicated process of finding the right travel insurance. Offering a comparison tool that aggregates various insurance providers, it allows travelers to review and purchase policies that fit their needs, whether for a single trip, annual coverage, or more specific situations like adventure travel or medical evacuation.

How InsureMyTrip Works

InsureMyTrip simplifies the process of finding, comparing, and purchasing travel insurance by acting as a one-stop platform for consumers. Here’s how it works:

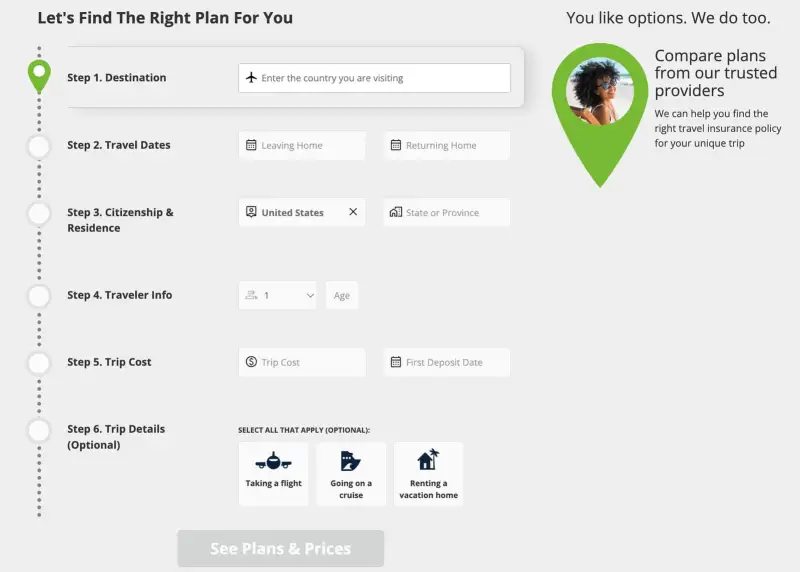

Input Trip Details

The process begins by entering key information about your trip. This includes:

- Destination: Where you’re traveling (domestic or international)

- Trip Dates: The start and end dates of your trip

- Traveler Information: Age, residency, and the number of travelers

- Trip Cost: Optional, but helps tailor insurance options (useful for trip cancellation coverage)

Once entered, InsureMyTrip provides a curated list of insurance policies that fit your specific trip needs.

Compare Insurance Policies

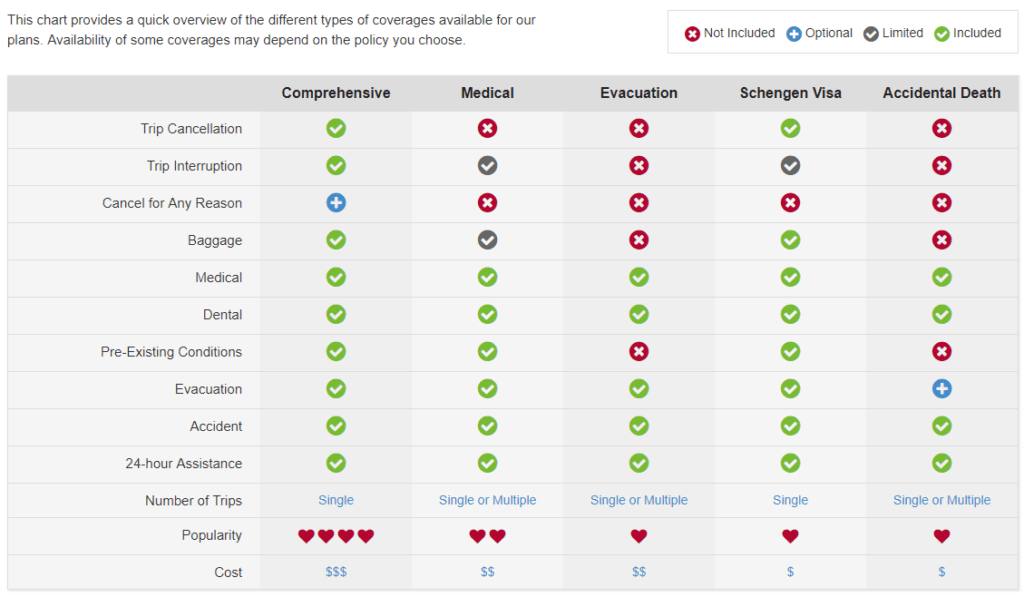

After inputting trip details, the platform generates a range of travel insurance options from different providers. You can filter the options by various factors such as:

- Coverage Type: Trip cancellation, medical coverage, evacuation, etc.

- Price: Compare policies based on cost, helping you find one that fits your budget.

- Provider Ratings: User reviews and ratings give insight into the quality of service provided by the insurer.

The comparison tool allows you to see the policies side-by-side, with a breakdown of coverage benefits like medical limits, reimbursement amounts, and emergency services.

Read Detailed Policy Information

Each policy comes with a comprehensive breakdown of coverage and exclusions, so you can fully understand what is included. InsureMyTrip also provides user reviews, helping you gauge the experiences of past customers and make an informed decision.

Customize Your Policy

For travelers with specific needs (such as pre-existing medical conditions, adventure sports coverage, or senior travel insurance), the platform allows you to refine the search. You can add special coverage based on your preferences or needs.

Purchase the Policy

Once you’ve selected the right plan, you can purchase it directly through the platform. The process is secure, and payment is handled through the insurer, with instant confirmation sent via email.

Filing a Claim

In the event you need to use your travel insurance, InsureMyTrip provides support. The platform offers guidance on how to file a claim, including detailed instructions and contact information for the insurance provider. They also provide customer service to assist with claim disputes or clarifications.

Customer Support

If you have questions during any step of the process, InsureMyTrip offers support through phone, live chat, and email. Their team is available to help with policy selection, understanding coverage, and even assisting with claims after a trip.

Key Features

- Wide Range of Options

InsureMyTrip stands out by partnering with multiple reputable insurance providers. This ensures users can find policies that suit different needs and budgets, from basic coverage to premium plans. You can compare policies side-by-side, making it easier to weigh options and select the best plan. - Easy-to-Use Interface

The website’s interface is intuitive, allowing users to quickly input their trip details and receive tailored insurance options. Filters like coverage limits, deductible amounts, and specific inclusions (like trip cancellation or medical coverage) make customization simple. - Expert Advice and Resources

One of the standout features is the wealth of resources available, from travel insurance guides to advice from industry experts. The platform also offers customer reviews, helping travelers make informed decisions based on the experiences of others. - Price Comparison

InsureMyTrip is ideal for cost-conscious travelers, as it shows a clear comparison of prices and coverage levels. The transparency in pricing allows users to see where they can save without compromising on essential coverage. - Customer Support

The platform provides exceptional customer support. Whether you need help choosing a policy or filing a claim, their support team is available via phone, email, or live chat, making the experience seamless. - Customizable Coverage

For travelers with specific needs—such as seniors, adventurers, or those requiring medical evacuation—InsureMyTrip allows for tailored policies. This level of customization ensures that you’re not paying for unnecessary coverage but have peace of mind for the risks that matter to you.

Pros:

- Extensive selection of insurance providers

- Simple comparison tool

- Comprehensive customer resources

- Competitive pricing

- Excellent customer support

Cons:

- The sheer number of options can be overwhelming for first-time users

- Some niche insurance needs may require additional research outside the platform

Conclusion:

InsureMyTrip is an excellent choice for travelers looking for flexibility and clarity when selecting travel insurance. Whether you’re planning a short getaway or a long-term adventure, InsureMyTrip helps streamline the process of finding and purchasing insurance, ensuring that you’re well-covered without overpaying.