Check out SafetyWing Nomad Insurance: https://safetywing.com/?referenceID=25017622&utm_source=25017622&utm_medium=Ambassador

You’ve probably heard about SafetyWing as a lot of travel blogs recommend them online. Plus, compared to most of other travel / nomad insurance, they have a very young image, their website has a very fresh look… They aren’t really the average travel insurance .

But when talking about travel / nomad insurance, nobody really cares about a beautiful website and a lot of recommandations. The most important is what the travel insurance covers you for, the expenses limits, the conditions… And that’s what we are going to talk about in this SafetyWing insurance review.

SafetyWing is the first travel insurance that created a coverage especially for digital nomads back in 2018 with their Nomad Insurance plan (even if their products also perfectly fit the needs of backpackers and long term travellers). So in this review we are going to check the pros and cons of their Nomad insurance coverage and see how it compares to other more traditional travel insurances.

This page about SafetyWing Nomad insurance is a complement to our guide and comparison of the best long term travel insurance. We hope that our SafetyWing insurance review will help you choose the best travel insurance for your project.

Who are the people behind SafetyWing nomad insurance?

SafetyWing is first and foremost the story of 3 Norwegian friends, all digital nomads, who could not find a travel insurance that met their needs as nomads at an affordable price. As they could not find a solution and seeing the rise of the digital nomad movement, they decided to create it!

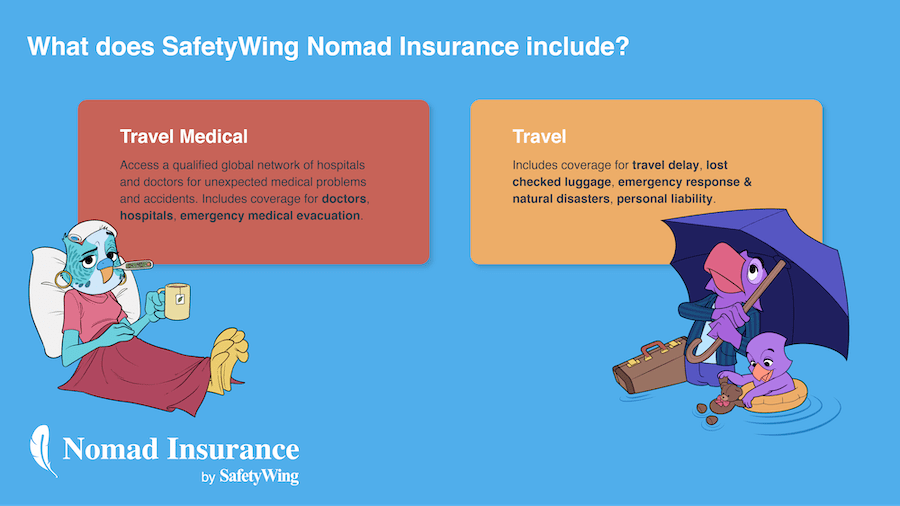

Their ultimate goal is to try to create a whole network of insurance products specially designed for nomads, freelancers and remote companies. They therefore decided to start with a travel and medical insurance with the following features:

- Reliability (the foundation for travel insurance)

- Flexibility (you don’t need to know how long you will travel in advance, you can subscribe while traveling)

- …

After a stay in the famous Startup incubator Y Combinator, SafetyWing was launched as the first travel and medical insurance for digital nomads.

SafetyWing Nomad Insurance: How does it work?

There are a few things that differentiate SafetyWing Nomad insurance from more traditional travel insurance such as TrueTraveller, ACS globe partner, Chapka Cap aventure or AVI Marco Polo.

- The coverage works like a subscription that is renewed every 28 days from the date of departure. So you don’t really need to know in advance how long your trip will last.

- It is possible to subscribe to SafetyWing from abroad even if the trip has already started.

- SafetyWing includes partial coverage in your home country for max 30 days every 90 days. Very useful for nomads who sometimes return to their home country.

- Each subscription also includes a child under 10 years old… which makes SafetyWing VERY attractive for families travelling with young children.

- This coverage is competitive in terms of price: $42 / 28 days.

But as I told you earlier, SafetyWing travel insurance (even if it is branded for digital nomads) is also very suitable for backpackers and long-term travellers because it meets all the important criteria that any travel insurance has to meet:

- Medical expenses up to 250’000$ which is ok but notre great compared to other backpacker and travel insurance.

- Repatriation (100% of actual costs up to 250’000$)

- Personal liability (25’000$ for bodily injury and 25’000$ as well for material damage) which is quite low compared to most of other long term travel insurance.

You can easily compare all the guarantees and different coverage limits of the best backpacker and long term travel insurance in our interactive travel insurance comparison table (which includes TrueTraveller, Heymondo, Globelink, SafetyWing and many others).

To register for SafetyWing, it’s easy, just go to their website and fill out a short form that takes 30 seconds to complete.

And if you’re wondering if you can trust SafetyWing despite its young age, their insurance coverages ar backed by WorldTrips (part of the Tokio Marine group), one of the world’s largest insurance companies (which are available 24 hours a day, 7 days a week in case of problems during your trips). In addition, the famous Startup accelerator Y Combinator where SafetyWing was born has also seen the birth of companies such as AirBnb, Dropbox and many others. This shows they are a serious company.

Our SafetyWing Nomad Insurance Review

Even if we love some of the things SafetyWing created for digital nomads (subscription model, partial coverage in your home country, on the road subscription) we have to say that the conditions they provide are a bit weak compared to other travel insurance on the market. If you like their subscription model, we still think they offer good value for your money. But if you want higher medical expenses limits and a better personal liability, I would rather choose TrueTraveller or Heymondo (-5%). But we will let you judge for yourself by comparing these nomad / travel insurances by clicking on the link below:

Other insurances from SafetyWing

SafetyWing has just released a new and very innovative product called Remote Health. Traditionally, health insurances have always been tied to where you live. But with the rise of nomadic lifestyles and 100% remote companies, there was a growing need for health insurance coverage that was not tied to your residency. So whether you’re a nomad, an entrepreneur, or just travel a lot, with Remote Health, you’ll have comprehensive health insurance that covers you anywhere in the world (even in your home country)!

Note: At the moment (january 2023), remote health for individuals is still on waiting list. It is only available for remote companies for now. But it’s a really innovative product that could change the way health insurances have worked until now (tied to a country).

The little plus of SafetyWing

SafetyWing is a resolutely young company, with a strong presence on social medias and also organizes events around the world to try to create a small community. We really do find the family spirit that we usually have among digital nomads and that’s really nice.

Plus they develop really innovative products that have the potential to change the way travel/health insurance is working now. With the rise of remote work, we really need new solutions that are not tied to a specific country.

Our final SafetyWing insurance review

| Positive | Negative |

|---|---|

| Affordable price, even the cheapest in some cases (families with children under 10 years old!)Its flexibility with the payment as a subscriptionA very intuitive website with a simple and fast subscription processPartial coverage in the country of residence | A deductible of $250 per contract (not for each claim)Personal liability coverage limits (25’000$) too low for our tastewebsite only in English for the moment |

SafetyWing is a company that brings a new energy to the slightly aging world of travel insurance and offers decent coverage at an attractive price. Honestly, we are looking forward to see what SafetyWing has in store for us in the future (the remote health insurance for individuals will be a very interesting product).