Visit the website: https://safetywing.com/?referenceID=6868&utm_source=6868&utm_medium=Ambassador

If you have ever read my former articles you already know that I am a firm believer that getting travel health insurance is a must. Whenever you go through the planning process you should get one that allows you to feel safe and relaxed when traveling.Information you need about SafetyWing Travel Insurance and what I think of it.Here, you will find all of the SafetyWing Insurance review.

Knowing that you will get your money back if a trip is interrupted, delayed or if your luggage is lost. It is also important that you find one that covers medical emergencies, including ambulances and hospital expenses.

I recently heard about SafetyWing and after trying it I actually enjoyed it. Here is what it is all about.

Travel Insurance Review: SafetyWing

SafeWing offers global travel insurance for people who are location independent. People like me who travel a lot or that doesn’t have a home base often are unprotected from emergencies.

The company caters to the needs of online freelancers, entrepreneurs, and remote companies. Founders are nomads themselves and are looking to keep adding products and services to improve a traveler’s safety net.

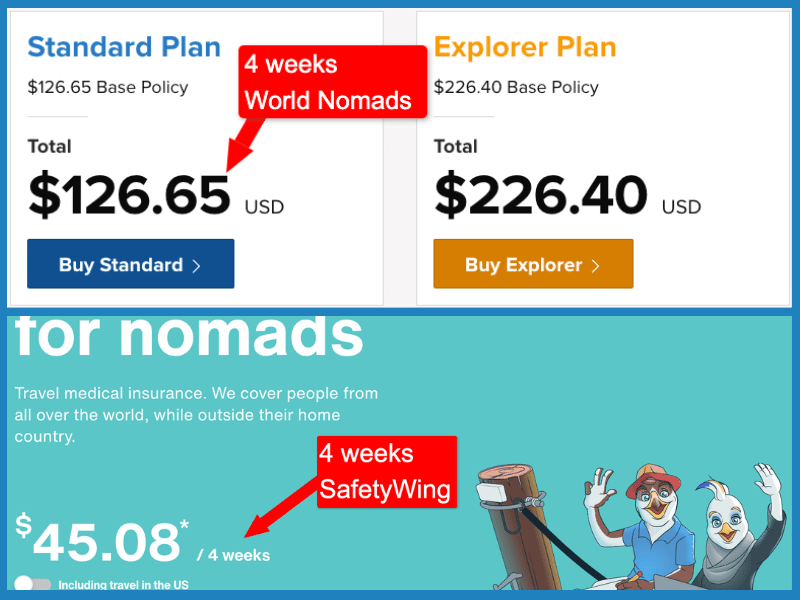

As mentioned above, their insurance covers people from all over the world, while outside their home country. Prices for a four-week service go from $37. But it can be customized for the exact amount of days that you will be traveling. Use their calculator to get the cost for your particular needs.

They definitely have the best BEST prices I have yet found anywhere online. And I travel a lot and have used many different travel insurance companies. None compare to them in price and services.

What it offers

Buy abroad, stay abroad – This might be one of the most convenient things about it. You don’t have to be in a certain place or country to purchase it. Everything happens online. even if you are already traveling.

Automatic monthly payments – If you don’t have an end date yet, you can choose this option so that the fees are discounted automatically and you don’t have to worry. You can set an end date later.

Visits to home country are covered – If you have been using the service for 90 days or more, it will also cover you for 30 days in your home country if something happens while visiting. *NOTE: there are a few exceptions to this.

Young children included – Up to two kids 10 years old or younger can be included in your insurance without added cost.

Medical and Travel Coverage – You will be compensated for any medical assistance that you need abroad or unforeseen things that happen. Go to their website to get the full breakdown of their services.

Medical Insurance

SafetyWing covers you if you are in an accident or fall sick while outside your home country and need medical assistance.

- Max Limit: $250,000 ($100,000 for 65 years and above)

- Deductible: $250

- Hospital: Room and nursing services

- Intensive care: Up to the overall maximum limit

- Ambulance: Usual, reasonable, and customary charges when covered illness or injury results in hospitalization

- Urgent charges: $50 co-payment, not subject to the deductible.

- Physical therapy and chiropractic care: Up to $50 per day. Must be ordered in advance by a physician.

- Emergency dental: Up to $1,000. Not subject to the deductible.

- All Other Eligible Medical Expenses: Up to the overall maximum limit.

- Notable exclusions: High-risk sports activity, pre-existing disease or injury, cancer treatment

If you wish to learn more about the policy, you can read the full details on SafetyWing’s website.

Travel Insurance

The travel insurance includes coverage for travel delays, lost checked luggage, emergency response, natural disasters, and personal liability.

- Trip interruption: Up to $5,000. No deductible

- Travel delay: Up to $100 a day after a 12-hour delay period requiring an unplanned overnight stay. Subject to a maximum of 2 days. No deductible

- Lost checked luggage: Up to $3,000 per certificate period; $500 per item. Up to $6,000-lifetime limit. No deductible.

- Natural disaster — a new place to stay: Up to $100 a day for 5 days. No deductible

- Political evacuation: Up to $10,000 lifetime maximum. Not subject to deductible

- Emergency medical evacuation: Up to $100,000 lifetime maximum. Not subject to deductible or overall maximum limit.

If you wish to learn more about the policy, you can read the full details on SafetyWing’s website.

Features

Nomad Insurance got an excellent reputation amongst long-term travelers, expats, and digital nomads because of its unique features.

- If you are between 18-39 years old, you can purchase Nomad Insurance for $42 per 4 weeks if you are not traveling to the United States or $77 per 4 weeks if you do.

- You can set up automatic monthly payments and stop the subscription anytime.

- You can buy insurance abroad, even when your trip is already started.

- You keep your medical coverage for 30 days in your home country if something happens while there after being abroad for 90 days. (15 days if your home country is the United States)

- You can include up to 2 children under 10 years old per family (1 per adult) free of charge.

Pros And Cons

Now, let’s take a look at the pros and cons of using SafetyWing when traveling.

Pros

- You can buy the insurance even if you are already on your trip

- The price is very affordable compared to most travel insurance providers

- You can include your family members in the plan (up to 2 children under 10 years old)

- The insurance covers a wide range of countries

- You get coverage for up to 30 days in your home country if you need to go back for any reason

Cons

- There is no coverage after 69 years old

- The medical coverage is not as comprehensive as some other providers

- The deductible can be quite high

How Does SafetyWing Compare To Other Travel Insurance Providers?

A few things set SafetyWing apart from other travel insurance providers.

- The price is very affordable, especially for long-term travelers.

- You can buy the insurance even if you are already on your trip. This is perfect for last-minute travelers or if you extend your stay.

- The insurance covers a wide range of countries. You are only excluded from coverage if you travel to Cuba, Iran, Syria, and North Korea.

- You get coverage for up to 30 days in your home country.

Is it really useful?

Personally, I believe that this service offers all of the basics that you need to be covered for when you travel for a reasonable price. After over 20 years of traveling alone and with my family we have had a lot of things happen to us. Everything from having to go to a clinic for a mysterious fever to losing our luggage and getting delayed.

All of these things can cost a lot of money. So you’d better be protected.

SafetyWing is easy to purchase and makes me feel comfortable. So far I haven’t had the need to use it but so far I’m enjoying this service.

Know more: https://safetywing.com/?referenceID=6868&utm_source=6868&utm_medium=Ambassador